I am the 1 percent

This past April was the first time I did my own taxes. It was also my first full year of being a freelancer. I wanted to understand what was going on with my taxes so I could have more control over them. This past year also happened to be a big year for the occupy movement that pit the 1% against the 99%. I want to address only the small portion of the protest: tax cuts for the "super rich". After learning a bit about how taxes work, I found that it also applied to me, and I'm far from a millionaire.

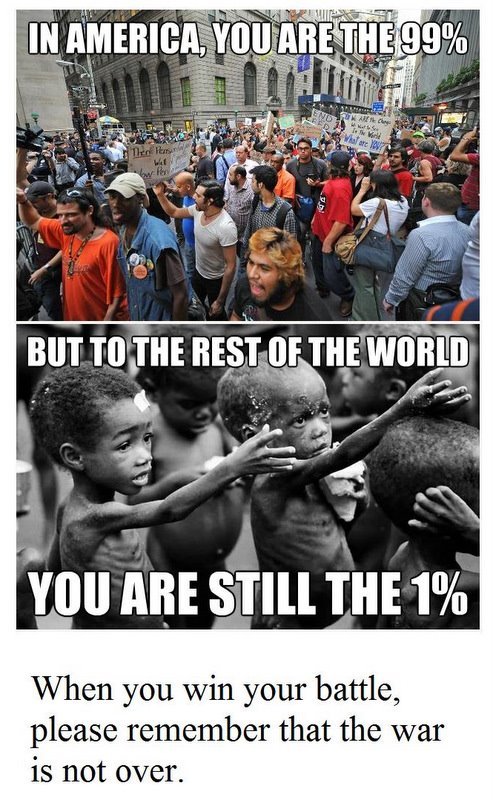

"Super rich" is a relative term. A friend of mine shared this on Facebook, and I think it's a great perspective to have:

Let's be honest. How many people in the world would pass on tax breaks or loopholes if it meant losing millions of dollars? This is not unique to millionaires. I'm not a millionaire, but I have plenty of opportunities to save on taxes by doing next to nothing.

Recently, a CPA told me how I could've saved a significant amount of money on taxes. It's common for people like me who are self-employed to register a business as a Limited Liability Company (LLC). What it basically does is separates your income into groups and labels them as X and Y. X is your salary as an employee which is taxed just like everyone else. But Y is taxed as "dividends" or whatever made up jargon it's called. And that portion is taxed less. Whatever is left goes in the pocket of the "shareholders" of the LLC. And what do you know, the owner and the employee are the same person.

Let me put numbers to it so it's easier to see what happens. These are not real numbers or percentages. I just made up reasonable-sounding numbers to demonstrate how it works. I'm also not including the tax bracket "step-ups" just to keep the numbers even and simple.

Let's say I earned $100K last year.

As a normal, self-employed, non-LLC person, my salary is $100K. Let's say I get taxed 30%. That's $30K. Simple.

On the other hand, as an LLC, I can divide the income into 2 groups: salary I pay to employees, and "dividends" or "profits" that go to "shareholders". I only have 1 employee, and I'm going to say his salary is $40K. Not only is the taxable income reduced from $100K to $40K, it probably dropped the salary into a lower tax bracket. So let's say it gets taxed 20%. That's $8K.

The remaining $60K of "dividends/profits" is not counted as income. "Dividends" don't get taxed like salaries. Let's say it gets taxed 15%. That's $9K.

$8K income tax + $9K on "dividends/profits" = $17K. Compare that to the $30K for a non-LLC. That's a savings of $13K or 13%. Compare those savings to a salary based on minimum wage ($7.25 per hour) which is ~ $15K before taxes. Whatever the actual amount I could save, it's more than many poorer people in the world probably could make in 10 years of working in much shabbier conditions than I do.

And what did I do to deserve these tax savings? I didn't use my car to deliver food to shelters. I didn't use my tools to help fix a house damaged by a natural disaster. I didn't share my home to foster an abused kid. I didn't spend time to volunteer at my neighborhood school. I didn't spend time going to hospitals to visit terminally ill kids. Nope. All I did was sign a piece of paper.

It gets better. Up until a few days ago, it didn't really hit me what "Limited Liability Company" meant, even months after someone explained it to me. "Limited Liability". Strip away the jargon and it translates to "not as responsible when bad stuff happens". If the company gets in trouble, the company gets blamed, not the employees. In other words, if something goes wrong, I get to throw up my hands and say "Hey, I just work here." If I somehow screw up something and someone's business is ruined because of me, I can legally setup another tent with a different name on the sign and I can keep doing what I've been doing. I don't mean that I can do illegal things and get away with it. But this is a legally gray area that certainly gives me more protection that I think I deserve. Even the person that explained it to me and encouraged me to register as an LLC told me that criminals have used the same protective umbrella of an LLC to their advantage. On the other hand, if someone gets a felony for smoking/selling pot, that follows them everywhere they go and is attached to every job application they ever fill out.

I'm sure (and hope) there are positive things that an LLC can do to help people. But for my work situation, the way I see it, it's nothing more than a fictional shield used in real life and a way to save on taxes when the only thing I did differently was sign a piece of paper. Do "self-employed" people in third world countries have the same tax advantages that I do? What makes me so special that I get to save more money just for signing a piece of paper? I'm not a millionaire with lawyer-like CPAs at my side. But I have the opportunity to get significant tax cuts with an LLC. And if I got in some kind of business trouble, I could probably bend things to avoid punishment because of the protective LLC bubble. If someone like me has access to these things, it's no wonder how all those "criminal" CEOs "got away with it" and got away rich.

I'm not trying to smear anybody for being money-conscious just like me. But if we care about equality, then we should be helping those who need help more than others. Tax breaks should be given to those who deserve a break. You can define "deserve" however you want. But for me it means those people who are less fortunate than I am. If not for them, then who are tax breaks for? Or are these tax breaks just made up rules to help rich people stay richer than everybody else?